In today's fast-paced legal landscape, efficiency is paramount. Law firms and in-house departments are constantly seeking ways to boost productivity and streamline operations. One crucial area for improvement is case tracking. Manual case management systems can be time-consuming, prone to errors, and often lack the comprehensive visibility needed for effective decision-making. Automating case tracking offers a robust solution to these challenges, enabling legal professionals to work smarter, not harder.

By implementing automation technologies, law firms can consolidate all case information in a single, accessible platform. This allows for real-time tracking of case progress, deadlines, and key milestones. Automated workflows can also be configured to trigger specific actions based on predefined events, ensuring that nothing falls through the cracks.

The benefits of automated case tracking are manifold. It reduces administrative burden, minimizes human error, and improves visibility across all stakeholders. Furthermore, it provides valuable insights into case performance, enabling firms to identify areas for improvement and optimize their legal strategies.

Enhancing Financial Service Providers Through Intelligent Automation

The lending industry is aggressively evolving, driven by growing customer requirements and the obligation to streamline operational performance. Intelligent automation delivers a transformative strategy to address these challenges, enabling financial service firms to prosper in this evolving landscape. By automating repetitive and complex tasks, intelligent automation releases human talent to focus on higher-value activities that foster user satisfaction.

- Benefits of intelligent automation in financial services include:

- Minimized operational costs and enhanced profitability.

- Improved customer satisfaction.

- Quickened processing times and minimized turnaround times.

- Heightened compliance and hazard management.

Automation for Compliance

In today's intricate regulatory landscape, organizations navigate a myriad of compliance obligations. Legacy methods for ensuring adherence can be resource-intensive, leaving businesses vulnerable to reputational penalties. Automation for compliance emerges as a transformative solution, alleviating risk and streamlining regulatory processes.

By leveraging automated platforms, organizations can execute routine tasks such as data collection, policy administration, and documentation. This not only enhances efficiency but also reduces the risk of human error, a common cause of compliance failures.

Additionally, automation empowers organizations to track regulatory changes in real time, enabling timely adjustments to internal processes and guidelines. By embracing automation for compliance, businesses can create a robust framework that fosters reliability while promoting sustainable growth.

The Rise of Staff Automation in Financial Services

The financial services industry is undergoing a period of significant transformation driven by the rapid implementation of automation technologies. This trend enables increased efficiency, cost reduction, and enhanced customer experiences. Banks are increasingly incorporating AI-powered tools to automate tasks, ranging from data analysis to customer service. The benefits of staff automation are evident, leading to a shift in the way financial services are provided.

This implementation of automation is not without its obstacles. It requires careful planning, investment in infrastructure, and upskilling of staff to ensure a smooth transition. Moreover, there are regulatory considerations surrounding the use of AI in financial services that need to be addressed. Nevertheless, the potential effect of staff automation on the financial services industry is undeniable, and its advancement is poised to continue at an accelerated pace.

Case Management Software A Deep Dive into Automated Workflow Management

In the dynamic legal profession, managing cases efficiently is paramount. This is where a robust legal case tracking system emerges as a crucial tool. These systems streamline numerous processes, freeing up valuable resources for lawyers to focus on what really matters: providing expert representation.

- Process Automation:

- Distribution of Cases

- Centralized Records

A legal case tracking system with integrated automated workflow management capabilities can significantly enhance productivity. By setting clear stages in the case lifecycle, these systems guarantee that every action is completed in a timely and organized manner. This not only minimizes the risk of oversights Litigation Tracking Software but also strengthens overall case management.

Streamlining Compliance Monitoring Through Automation: A Proactive Risk Management Strategy

In today's dynamic regulatory landscape, organizations face unprecedented challenges in ensuring compliance. Manual monitoring methods are often inefficient, leading to a reactive approach that fails to address emerging risks effectively. Automating compliance monitoring offers a strategic solution by providing real-time insights and enabling organizations to identify and mitigate potential violations before they escalate.

- Technology-driven processes empower businesses to monitor compliance requirements across diverse systems and data sources, improving the accuracy and promptness of monitoring efforts.

- By leveraging analytics, organizations can uncover patterns and anomalies that may indicate potential risks.

- Proactive intervention based on automated alerts allows businesses to resolve issues promptly, minimizing the impact of non-compliance and reducing financial penalties.

Adopting an automated compliance monitoring strategy not only reduces operational risks but also fosters a culture of accountability within organizations. By empowering employees with real-time information and clear expectations, businesses can promote ethical conduct and enhance overall governance.

Neve Campbell Then & Now!

Neve Campbell Then & Now! Dylan and Cole Sprouse Then & Now!

Dylan and Cole Sprouse Then & Now! Tatyana Ali Then & Now!

Tatyana Ali Then & Now! Anthony Michael Hall Then & Now!

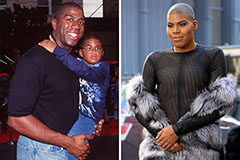

Anthony Michael Hall Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now!